In this piece I am going to introduce a simple model of economic flows. This is by no means new or novel but something I put together as a way to think about contemporary problems in society. I apologize in advance that it is very simple and I am sure there are better models out there but putting it together helped me to organize my thoughts and I share it with that in mind.

I have deliberately left out the Bank of England and flows of money in and out of the country although I hope to come back to these in the future. Therefore, it is a simplification but then ‘all models are wrong but some are useful’. I hope this is useful.

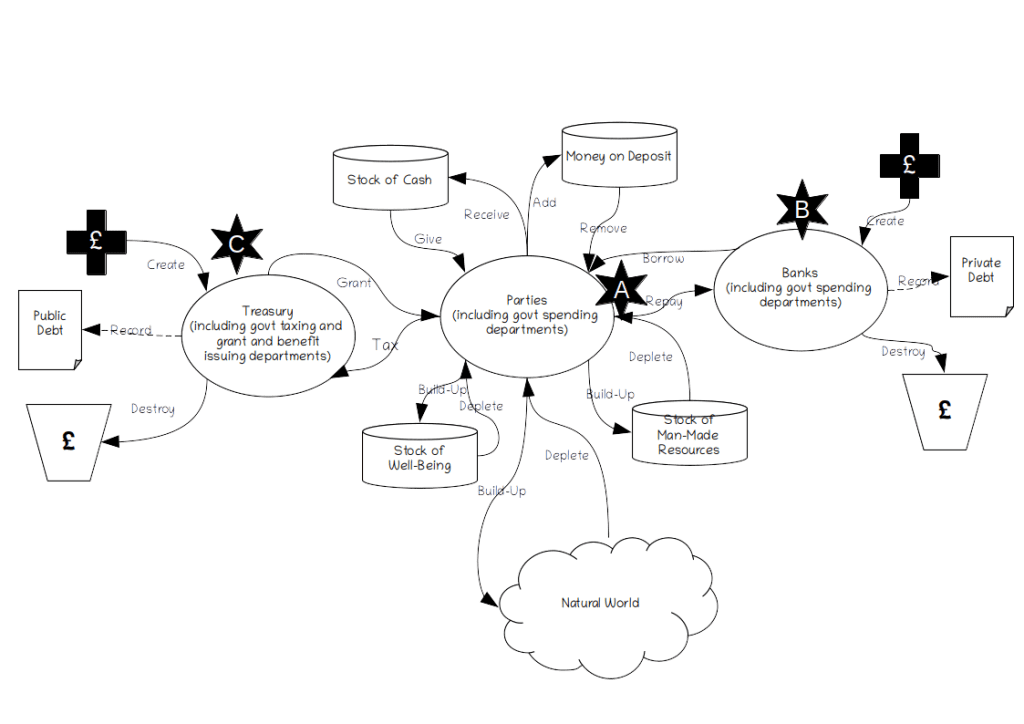

The basic financial model

Starting at A. Parties undertake activities that have an economic aspect. The parties could be individuals, organizations or other collective activity, or they could government departments who undertake work and are in receipt of money currency from the treasury (or who receive other kinds of funds such as fees from service users). The parties spend and receive currency either in the form of cash or via the financial system. The activity results in the movement of currency between parties and no net change to the amount of currency in the system.

The parties might also receive currency in two other ways.

- They receive grants or benefits from the government (including government agencies or local authorities who disperse money).

- They receive currency in the form of loans or credit from financial institutions.

The parties might disperse currency other than to another party as either:

- Payment of taxes or other government levy or duty.

- Repayment of amounts previously loaned by a financial institution.

At this stage there is no net change to amount of currency in the system.

Therefore, how does currency enter the system.

- The difference between the currency flowing out of the part of government that disperses currency to be spent by government departments, agencies and local authorities and the currency flowing into that part of government represents either new currency created or currency destroyed (B).

- The difference between the currency issued by banks as loans and credit and amount received by bank as repayments represents either new currency created or currency destroyed (C).

Therefore the amount of currency in the system represents the difference between the amount issued by government in the form of benefits and grants and to be spent by government departments, agencies and local authorities and the amount recovered by the same in taxes, duties and other levies (so called “government debt”) PLUS the difference between the amount loaned by financial institutions to parties (including the parts of government that undertake economic activity) and the amount repaid to the financial institutions by the same (“private debt”).

A number of observations can be made using the model.

Everthing else being equal, economic growth must increase ‘debt’.

- The amount of economic activity can be measured by looking at the currency flows between economically active parties.

- The amount of economic activity will be a factor of many things but depends on there being sufficient stocks of currency sitting with non-government parties in the form of cash or bank deposits to enable one party to trigger economic activity from another through the payment (either in advance, at the time of, or at an agreed time after the activity occurs) and with government parties to trigger economic activity in response to non-government party’s need or decision making within the government party.

- These stocks of currency can only come from one of two places; the part of government that disperses currency or the banks.

- If economic growth is a goal of a society and all other things being equal for there to be economic growth there must be a growth in the stock of cash and deposits which in turn requires a growth in either “government debt” or private sector debt.

Everything else being equal cutting public debt must must increase private debt.

- If economic growth is considered desirable AND public debt is considered undesirable then economic growth must lead to increased private debt since this is the only other source of addition stocks of cash and deposits to fuel economic growth.

Non-financial aspects

The remainder of the model looks at the non-financial aspects of the activities undertaken by the parties.

Activities undertaken by the parties will impact on the well-being of the parties themselves and / or the other parties involved in the activities. Government activities are often specifically designed to improve the well-being of other parties, for example by providing health care or education, or may be designed to mitigate risks that if they mature would deplete well-being, for example by promoting good health, or by preventing crime. But activities undertaken by non-government parties can have the same effect, for example by providing opportunities for leisure, cultural enrichment or other activities that promote well-being like fitness classes or providing opportunities to socialize.

In addition, the undertaking the activity may improve or deplete well being by providing income but also enjoyment and pride in work or conversely failing to provide an adequate income or by providing insufficient enrichment. Similarly, whilst benefits might provide a stock of currency that allows a party to avoid want, the amount may be insufficient to allow the individual to make good choices about how to use the currency leading to a depletion of well-being and the accompanying lack of meaningful activity in the form of work or the activities that an income derived from work can provide may itself deplete the party’s well-being.

Many forms of activity either take resources from the natural world to enable the activity to occur or to be converted by the activity into stocks of man made resources, thus depleting the natural world. Similarly, many activities pollute the natural world depleting its ability to recover and restore itself. A small number of activities might actually build up the natural world or increase its ability to absorb waste and make it harmless.

Most economic analysis fails to account properly for the true impact of converting the natural world into man-made resources (for example cutting down rain forests to farm cattle or grow palm oil), the value associated with the well-being of the parties in the systems and the depletion of the natural world, including its ability to absorb the waste produced by the activities undertaken by the parties in the system including the production of C02 and other greenhouse gases.

Conclusion

In this piece I wanted to focus on presenting the model as a means to think about issues facing the world and did not want to stray into making recommendations or proposing policies. This is because I want the model to be able to be used by anyone irrespective of their political leanings to investigate and propose policies but respectfully asking them to examine the impacts of these proposals not just from a financial perspective but also in terms of their possible impact on well-being (other some or all of the parties in the system depending on their political outlook) and on the stock of man-made resources and on the natural world. Whilst it is not necessarily true, I would hope that most people will want to design policies that promote a future for the parties in the systems (our children and our grandchildren) and that opening up the model to include these additional perspectives will provide a useful tool to think about and evaluate possible policies and political philosophies.